The Americas, which is seeing an “encouraging” regional return of domestic travel and recovering duty-paid shopping, has helped Dufry’s business inch up in first quarter 2021. Plus, the travel retailer’s opening of a 3,000 sq meter store in Hainan in collaboration with Alibaba Group and Hainan Development Holding, gives it its first foothold in the burgeoning Chinese market, a positive development for the future.

Nevertheless, Dufry’s turnover in the first three months reached CHF 460.3 million (US$513 million) with organic growth down by -73.9% compared to 2019 (down -66.7% vs Q1 2020). Like-for-like performance came in at

-68.3% vs 2020 due to continued reduced passenger traffic across most airports and other channels globally, reports the company.

However, Dufry reports that it is on track to achieve CHF 530-670 million savings compared to 2019 in personnel and other expenses for FY 2021, and has signed MAG reliefs for 2021 of around CHF 300 million.

Dufry says that around 60% of its stores are now open, representing close to 70% of sales capacity. This includes the successful partnership-opening of the strategically important duty free operation in Hainan.

Regional reorganization

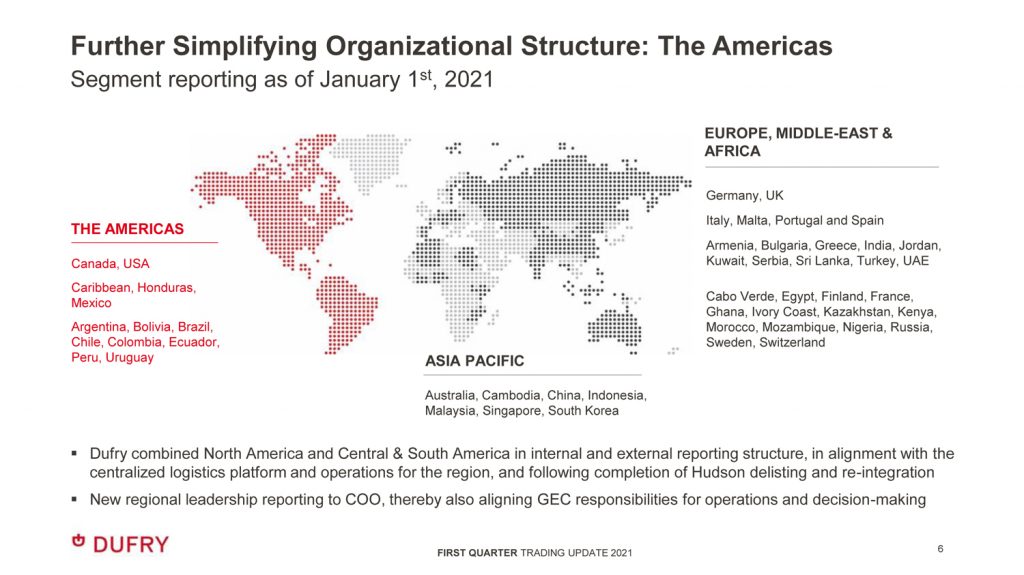

Two major developments took place in the Americas over the first quarter. In a reorganization first announced in June 2020, Dufry has retrospectively combined its North America and Central & South America operations as of January 1, 2021 into the new reporting segment The Americas.

The integration was facilitated by the successful completion of the Hudson delisting and full reintegration into the Dufry Group, and reflects the organizational decision-making process for the region as well as the aligned logistics platforms and operations. Dufry will now use its three regions, Europe, Middle East & Africa; Asia Pacific; and the Americas, as well as its distribution centers, for its segment reporting.

All three segments will directly report to Eugenio Andrades, Chief Executive Officer Operations and member of the Global Executive Committee.

Europe, Middle East and Africa contributed 29.8% of total sales in the first three months, Asia Pacific accounted for 5.4% of sales and the Americas contributed 53.4%.

Global distribution centers accounted for 11.4% of Q1 2021 net sales, which was mostly related to the Hong Kong operations temporarily providing supply to the Mova Mall shop in Hainan.

The Americas

Turnover was CHF 241.2 million in Q1 2021 as compared to CHF 644.2 million one year earlier and CHF 826.4 million in Q1 2019. Organic growth came in at -59.9% vs 2020 and at -67.9% vs 2019.

North America performed at the same level as Q4 2020, and since end of March the U.S. has seen a pickup in domestic and intra-regional travel activity thanks to the significant progress on vaccination and easing of restrictions.

Dufry and its Hudson brand are well positioned with its strong convenience presence in the region. Turnover was strongly driven by duty-paid during Q1 2021 with above regional and Group-average organic growth of -61.4% compared to Q1 2019.

Central America and the Caribbean, including Mexico, Dominican Republic and the Caribbean Islands, continue to perform more robustly compared to all other regions, driven by intra-regional travel from the US as well as a more flexible international travel regime.

South America’s performance was impacted by the pandemic situation and related new lock-downs in Brazil, however, partly mitigated by easing of restrictions in other countries like Peru.

Dufry Group CEO Julian Diaz, comments: “We are seeing encouraging signs for resuming travel trends and shop re-openings in the regions that have most progressed with vaccination campaigns and have established cross-border travel protocols accompanied by clear procedures and necessary documentation for travelers.

“Customer behavior indicates continued demand for travel and travel retail, and we are well positioned to accelerate sales with further re-openings. The close relationship with our landlords, suppliers, employees and share-holders continues to be a valuable support during the recovery. We are confirming the scenarios we have laid out for 2021, and are confident that we can achieve the targeted cost savings for the year.

“As part of the re-organization and the streamlining of our processses, we have now merged our North, Central and South America businesses into one reporting segment to reflect the decision-making process for the region.

“This step has been facilitated by the completed Hudson reintegration as well as the alignment of our operations and logistic platforms.”

Diaz continues: “Over the last weeks, we have successfully executed the refinancing of all relevant maturities until 2024 at attractive terms by applying a diversified product mix of convertible bonds, senior notes and bank debt. This allowed us to reduce our net debt position while securing additional liquidity, which currently stands at CHF 2,213.7 million. In addition, we achieved an extension of the covenant holiday by another twelve months with the next testing now due in September 2022, and an increased threshold for both September and December 2022.

“The further strengthened financial profile adds to the significant achievements realized in 2020 with respect to the implementation of recurring cost savings of CHF 400 million, tight cash flow management and several financial initiatives to safeguard liquidity. We currently see progress on the re-openings in the U.S. and Central America, and on plans communicated by authorities globally for collaboration on cross-border travel.

“The new organizational setup and strong liquidity position allows us to drive the recovery, while also engaging in strategic partnerships and opportunities to accelerate growth.”

Outlook

In line with easing of travel restrictions by governments and resuming of operations by airports and other landlords, Dufry re-opens its retail businesses gradually, following single-location productivity scenarios.

At the end of April, more than 1,400 shops globally were open, representing around 70% in sales

capacity compared to full-year 2019. Newly re-opened locations include shops in Australia, Greece, Italy, UK and in the U.S., including Chicago, Dallas Fort Worth, JFK (NY), Los Angeles, Oakland, San Diego, San Francisco and San Jose, among others. At the end of May, Dufry expects to operate around 65% of shops, representing close to 75% of sales capacity.

In April, Dufry estimates organic growth (based on net sales) to have reached -70.5% compared to the same month in 2019 (-56.2% in The Americas).

Based on the already successfully implemented measures taken in 2020, the recent refinancing and the continued focus on cost savings, cash flow management and liquidity preservation, Dufry expects to be well positioned during the reopening while engaging in strategic initiatives and driving growth acceleration during the recovery.