by Mark Lewis-Jones

Let’s start with some good news. Despite whatever catalytic effects the global public health crisis had on online purchasing of consumer goods, e-commerce only accounted for a relatively small percentage of retail sales. According to Stats Canada, for 2020, Total U.S. retail purchases were $5.6T with 14.1% attributed to e-com, and Total Canada retail was $606B with 8.1% attributed to e-com.

What might one infer from that? That the “retail apocalypse” is not nearly as bad as anyone imagined. That the brick-and- mortar retail location is still an important point of sale, and cogently, an important point of experience.

So while watch sales in travel retail definitely took a shocking blow, it will not remain so forever. Granted, cruise ships have been laid up, and based upon geographic regions, travel bans have delimited transit through international airports.

Early bright spots include Hainan duty free in China, where most serious watch brands are investing, hedging their bets that this destination will be of major importance in helping sales recover from 2020. According to a report on March 22nd in the Moodie Davitt Report, sales continue to soar in this market. While this will help, it is not a cure-all for what ails the global watch industry. Let’s look pictorially at some recent figures from the FH (Fédération de l’industrie horlogère Suisse), as reported last month in the online newsletter, Horas y Minutos:

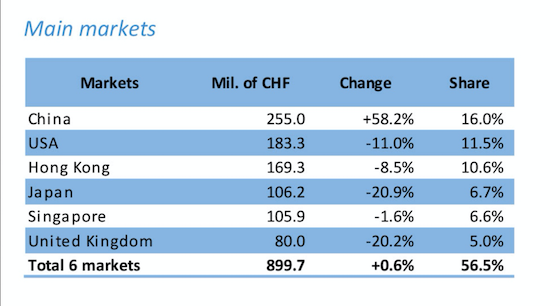

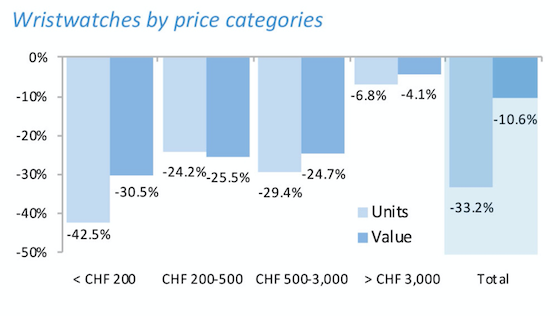

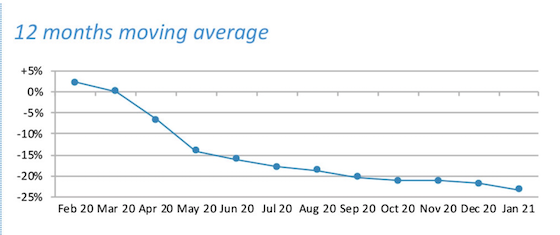

From the main markets, we can see that strong sales in China in second semester 2020 helped bolster sales, making the net figure slightly positive. 2021 sales in China, and especially Hainan, continue to help. But looking at the graph below, we can see 2020 sales were affected differently by price segment. The assault on entry level Swiss watches by wearables, and dominated by the Apple Watch, shows no sign of abating. Duty free operators may want to look at which pricing segment(s) deliver their best sales results, and focus on those segments, as every cubic foot (or meter) must deliver KPI results.

In conclusion, we can likely safely assume that once travel resumes via air and sea, sales results will steadily climb again, though it may take several years for figures to recover to pre-COVID levels, if they ever do. There continues to be an evolution of competing enterprises that include growth of brand-owned boutiques, D2C (direct to consumer), CPO (certified preowned) platforms, and the wearable (smart watch) segment.

Duty free operators should focus on best-performing price segments, introducing some sort of experiential interaction at the POS, solid value propositions for the traveler, and an assortment of current collections, including novelties. An overwhelming smorgasbord of aged inventory from the COVID period will likely not generate the sort of sales results desired, and could reflect negatively on the retailer. This challenge will require an investment of capital and clever planning, strategic alliances with brands, and a capable sales staff.

Finally, those interested in the important KPI of sell-out figures should consider the subscription based Mercury Report, which includes data on over 10 key markets, including travel retail. See: www. mercuryproject.ch

Mark Lewis-Jones is a member of the Board of Advisors, Watch Trade Academy, Neuchâtel, Switzerland

Caribbean / LatAm Representative, Watch Distributors Directory, Switzerland. mark@watch-trade.academy