The traditional “snowbird” winter season of travel between the United States and Canada continues to be impacted negatively by Canadian sentiment to actions by the current U.S. administration, with airlines adjusting capacity downwards, reports OAG.

Canadian airlines have reduced USA-bound capacity by nearly 10% for Q1 2026, representing 450,000 seats. Capacity shifts away from traditional U.S. sun destinations reflect a change in leisure travel demand, says OAG.

Canadian airlines are increasing capacity to Costa Rica and Mexico, however.

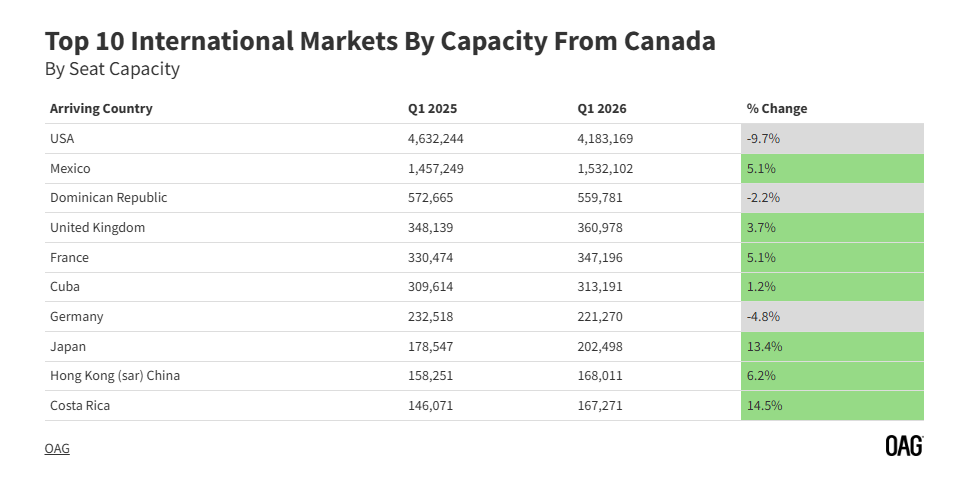

Canada’s international capacity for Q1 2026 is set to be 1% less than in 2025, with 75 international country markets served, one more than in 2025. New services to Israel and Nicaragua are planned

The ten largest international markets departing from Canada represent 8 million seats, comprising 75% of total international capacity.

The United States represents 39% of this capacity. However, scheduled airline capacity to the United States has declined by nearly 10% year-over-year, resulting in a 4% reduction in its share of Canada’s overall international capacity.

The increased capacity to Costa Rica (+14%) and Mexico (+5%) likely reflects a shift in leisure travel demand from traditional U.S. sun destinations, says OAG.

In addition, Japan is growing in appeal, and the destination saw a 13% rise in capacity. WestJet doubled its capacity to Japan and ZIPAIR added 6,000 additional seats to their schedules.

WestJet has also added 40% more capacity to Mexico year-on-year, adding five new seasonal destinations to their network. Cancun now accounts for half of its Mexican services.

The airline also expanded further into the Dominican Republic, where, aside from existing service to Punta Cana and Puerto Plata, new flights to Samana and La Romana have been launched.

Air Canada made a conscious strategic choice to develop more connecting traffic from Mexico to Europe. As a result, it increased capacity to Cancun by 20%, launched new services to Monterrey, San Jose del Cabo, and two other leisure destinations and has seen a 30% increase in traffic from Mexico to Europe. While this does not fully offset the loss of US “snowbird” revenue, additional capacity to the Dominican Republic and Italy has also helped to close part of the gap.

Half a million lost airline seats to the U.S.

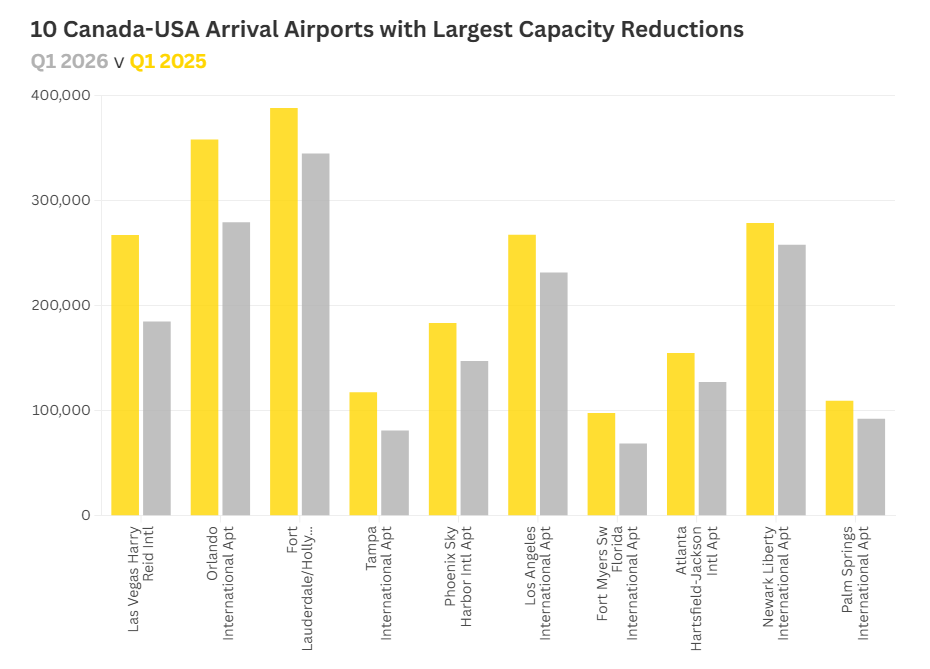

The 10% reduction in U.S.-bound capacity year-on-year equates to almost 450,000 fewer seats in Q1 2026, or nearly 5,000 fewer seats each day. Notably, over 95% of these cuts have come from Canadian airlines: WestJet has reduced its capacity by 19%, Air Canada is down by 7%, and Flair Airlines has made the most significant change with a 58% decrease in its U.S.-bound capacity.

Markets with significant leisure travel have been most affected by capacity cuts:

Las Vegas is seeing a reduction of approx. 82,000 seats (900 per day); and Orlando will see a decrease of nearly 79,000 seats from Canada. Major hub airports like Newark, Atlanta, and Los Angeles are also among the top ten in terms of capacity losses.

Destinations such as Las Vegas, Orlando, Tampa, and Fort Myers will face substantial economic challenges due to this drop in Canadian demand, and finding alternative sources of capacity to offset these losses will be challenging in the short term, says OAG.