It’s all about the hair! Not only do today’s consumers long for “shampoo-commercial-worthy hair,” (quoting Spate) but they see healthy hair as integral to today’s well-being journey. Consumers are looking for hair care products that cater to a range of needs, targeting various hair and scalp problems while providing multiple benefits from revitalization to anti-ageing. Whether you consider it the “skinification of hair,” or a “hair-evolution,” the hair care market is burgeoning, and many travel retailers want to take part in the trend.

The global hair care market was valued at US$91.60 billion in 2022 and is anticipated to grow from US$99.53 billion in 2023 to US$147.49 billion by 2030, according to Fortune Business Insights. That translates into a CAGR of 5.8% during the forecast period.

In the United States—the largest hair care market by value in the world—sales are expected to grow from US$16.17 billion in 2023 to US$19.20 billion by 2028, at a CAGR of 3.49% during 2023-2028, according to an analysis from research firm Mordor Intelligence.

Retailers like Sephora and Ulta are reporting record numbers of searches for hair care products on their websites. According to data from Spate, a beauty trend tracker located in NYC, hair care is chalking up record numbers of online searches across the board, from topics ranging from washing hair in a bowl and steaming caps, to problem-solving and revitalizing and anti-aging. Consumers are looking for shampoos that address concerns like frizz and damage, along with scalp care and hair loss prevention. According to a Spate report in June, for example, monthly consumer searches for revitalizing products is experiencing a YoY growth of +38.0%.

In another important trend, NPD reports that consumers are willing to pay more for hair care products that work for them. In a study issued last year, NPD forecast that hair care sales will surge 15% over the next two years, and that 90% of U.S. consumers continue to show strong purchase interest for hair-related products.

So what do hair care products have to offer the traveling public and how should travel retailers attract this consumer? And which travel retailers have begun testing the category?

Premium is critical

Operators and suppliers agree that products must be premium and offer something special to attract the travel retail customer.

Traveling consumers are looking for high quality products and professional endorsement that can support trusted professional quality, explains Marco Vitale, Head of Global Travel Retail & OPI EMEA Business Expansion Director at Wella.

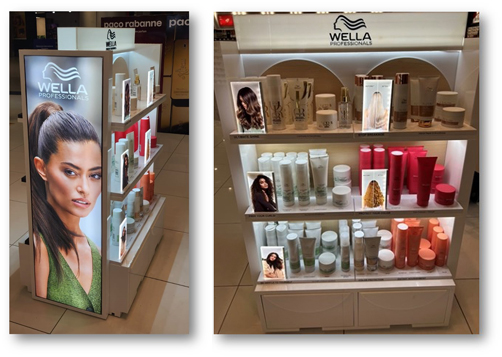

“Professional is the new Premium,” noted Vitale, who is spearheading the launch of Wella Professionals and Sebastian mega-brands into travel retail.

“Our expansion in Travel Retail officially started at the beginning of this calendar year, a few months after a very successful, first-ever attendance at TFWA Exhibition in Cannes in 2022. Thanks to the partnership with some of the key players in the channel (Dufry, Gebr. Heinemann, DFA, Viking Lines and many others), we are gradually entering top airports, cruise ships, duty- paid stores and all other relevant channels,” he said. “We believe there is a perfect match between Travel Retail and our brands.”

In the Americas, Wella Professionals & Sebastian are presently rolling out with Duty Free Americas (DFA), in its airport locations in Miami and Atlanta.

DFA sees potential

DFA’s Vice President of Purchasing, Joseph Falic, confirms that DFA sees the hair category getting much stronger. “We have introduced several brands over the past few years and currently carry Moroccan Oil, Sebastian, Wella Professionals and Kérastase in a couple of locations as well as products from L’Occitane, Kiehl’s, and a few others.

“We recently launched two more in our shops in the U.S. airports, some of our U.S. border shops, as well as in Panama. We also carry many hair care products in our border shops in South America. We are always looking to offer new products that are extensions to the current beauty category,” Falic tells TMI.

In fact, the Falic Group recognized an opportunity to invest in the haircare category and five years ago purchased an online only company that sells direct to consumers.

“The company has since expanded the product range carrying everything from our famous hair tools, shampoos, hair vitamins, and even hair extensions,” said Joseph Falic.

Cruising opportunities

The cruise channel offers an exceptionally promising venue for premium hair care assortments. The extended time onboard provides guests with ample opportunity to experiment with interesting new products. Starboard Cruise Services says that 80% of its onboard shops have specially curated haircare assortments across 13 of their cruise line partners.

“Starboard is committed to offering an inclusive selection of high-quality products that cater to diverse hair types and needs,” says Karla Nedeski, Senior Buyer. “Our overall mission is to deliver ‘Beauty for All’ and empower individuals to embrace their unique beauty and feel confident in their own skin. We strive to create a vibrant and inclusive world where everyone feels welcome and valued.”

As part of this mission, Starboard’s curated haircare assortments range from accessible price point brands such as Moroccan Oil, Mario Badescu, L’Occitane and Malin + Goet to high-end price point brands such as Sisley.

Starboard sees the current hair care trends as part of a larger focus on clean beauty and sustainability.

“The renewed interest in haircare coincided with consumers’ focus on health, well-being and sustainability. We’re also seeing a shift in consumers who care about brands that have integrity and want to engage with those that truly align with their personal values,” she explains.

“As we head into 2024, we’re seeing consumers seeking out hair products that contain natural ingredients to repair, protect and grow. We have integrated our focus on clean beauty and sustainability into our haircare selection and continue to grow our offering with some of the top performing brands in today’s market.”

Caribbean Hair Vibes

Travel retail distributor Tairo International, which specializes in the Caribbean and Mexican market, including airports, cruise ports, cruise ships and downtown stores, represents Moroccan Oil in this market and has seen first-hand how interest in hair care is growing in the channel.

“Our prestige hair care business with Moroccan Oil is booming,” confirms CEO Robert Bassan. “The brand is doing exceptionally well on the cruise ships, where it is one of the top-selling brands. We have Moroccan Oil listed with Starboard, Heinemann and Harding.

“We are also very excited to be launching the Wella hair care products into the Caribbean. Hair care is becoming an important part of the wellness trend and consumers are very interested in wellness. Plus hair care is huge in Latin America, and the Caribbean is a popular destination for Latins,” said Bassan.

Tairo’s sister company, Somar Distribution, carries an extensive portfolio of consumer care brands, such as Clairol and Clairol Professional, with a large selection of products for women of color. Somar distributes these in drug stores, supermarkets and pharmacies in the Caribbean.

“This business was booming during COVID-19, when so many people began doing their own hair care at home,” said Bassan. The business is still performing strongly, he said.

Rouge Duty Free, with beauty stores on the islands of Grenada, St. Croix, St. Thomas, St. Maarten, Grand Cayman and Tulum, Mexico, is stocking its stores with high luxury hair care collections.

“We already added a Hair Care section, and last May launched Leonor Greyl, one of the best hair products in the world, along with a list of other brands,” noted Raymond Kattoura, whose company Duty Free & Travel retail Group Inc. helps manage the business for Rouge Duty Free.

Kattoura says that French luxury brand Leonor Greyl is a pioneer in natural luxury haircare, creating sustainable haircare products for everyday beauty and professional stylists since 1968. The brand is rooted in nature and luxury, using the best natural ingredients enriched with proven botanicals and essential oils gathered from sustainable sources worldwide.

The airport approach

Not all duty free operators have embraced the hair care trend. New York-based International Shoppes (IS), which operates duty free concessions at JFK, Bradley International and Houston Intercontinental airports, does not have hair care as a key category due to lack of demand.

“Although we carry a few SKU’s in L’Occitane, hair care sales are quite low,” noted IS Beauty Buyer Marlene Friedman. “And we have had no call outs for hair care from our store managers during our touch base meetings,” she added.

In sharp contrast, L’Oréal Travel Retail pioneered the advent of prestige hair care into airport duty free in South America in 2015 with Grupo Wisa in Mexico City Airport and with Dufry in Rio de Janeiro and São Paulo.

L’Oréal announced in 2014 that it would be launching its Kérastase brand – the world’s number one professional hair care brand–using tailor-made dedicated Kérastase Studios for hair care; and would retail treatment brands Vichy and La Roche-Posay, through Dermacenter flagship “shop-in-shops,” in some of the most prestigious global travel retail locations.

L’Oréal opened the first two doors – one Kérastase Hair Studio and one Dermacenter—in Hong Kong with DFS Group that November.

L’Oréal opened its first Kérastase door in Americas travel retail with London Supply in its Puerto Iguazu store in March 2015, followed by the airport openings in Mexico and Brazil.

L’Oréal has continued to develop its Kérastase travel retail business through a combination of the effectiveness of the products, its luxury instore image and its professional approach, which begins with a hair diagnosis.

Optimizing assortments and promotion

As mentioned earlier, in order for a hair care brand to attract the traveling consumer, it has to offer something special and appeal to trending codes, ranging from treatment benefits to sustainability and luxury.

Bosley MD

One such brand is Bosley MD, the global thinning hair authority, which has just begun shipping orders to travel retail operators in Latin America through International Brand Builders Inc. Bosley MD provides holistic hair growth solutions for men and women from supplements and FDA approved regrowth solutions to daily haircare with botanical DHT inhibiting ingredients.

“Our products are created in collaboration with Bosley doctors and are stylist approved. Our brand was originally distributed in the professional channel so we are the go-to hair growth brand for the stylist. We now have an omni-channel approach and our products can be found in specialty retail as well as the drug channel,” commented Ana Lamarre, Account Director International.

Bosley MD had to put its plans to enter this channel on hold during the pandemic but has now shipped its first orders into LATAM, and says it will be presenting to other Travel Retailers in the coming months.

With 70 Bosley hair restoration clinics across the U.S. and more than 45 years of experience in the hair thinning space, Bosley MD is unique in the category “because we offer the experience and expertise of a doctor in a bottle,” said Lamarre.

“Travel retail is an intriguing channel for our business because it allows us to showcase our products and introduce our brand to a wide range of potential customers.

“This exposure in airports, duty free shops, and other travel hubs can significantly increase brand visibility and sales opportunities. Travelers often have time to browse and shop while waiting for flights or during layovers and this captive audience is more inclined to explore products, making it an excellent channel for showcasing our offerings. We also believe that having a presence in travel retail can enhance our brand’s prestige. Being available at prestigious airports or duty free stores can elevate the perceived value of our products.”

Bosley MD has a variety of sizes and presentations optimal for travel retail, from travel sized kits to full sized items for border stores and retailers with repeat customers.

“Our Hair growth kits offer consumers a chance to test out our volumizing system that is comprised of our top selling shampoo, conditioner and leave in thickening treatment,” adds Lamarre.

Wella Professionals & Sebastian

Wella Company’s Marco Vitale noted that the success the company has had with new listings since the beginning of the year clearly shows the growing interest from retailers in the hair category. “On top of that, we feel there is also the need and curiosity to feature something new in the channel in terms of offer to passengers, especially after the COVID crisis,” Vitale tells TMI. The Wella Company brands meet this need.

“Wella Company has more than 140 years of Hair Expertise. We have professional brands in our portfolio that have always served salons‘ needs. However, within our large assortment we have many products that can be sold to end consumers as well within the Wella Professionals and Sebastian mega-brands.

“Our brands have more than 140 years of history with trusted professional quality. We have a portfolio covering a wide range of hair benefits from care (with Wella Professionals) to care & styling (with Sebastian) but also different price points, in order to meet the needs of all our prestige hair care consumers,” he explains.

With so many options to choose from, how is Wella Company developing assortments specifically for travel retail?

Vitale says that working together with their education team, they only select bestselling SKUs and proved regimen to offer to their travel retail partners.

“These can be modulated depending on the retailers’ needs and space available,” he notes.

The Wella Company works with Premier Global Trading, Inc. as their service agent in travel retail in the Americas.

THG: Christophe Robin and Grow Gorgeous

“The evolution of the haircare space within Travel Retail should take into account both the essence of the brand and the allure of the consumer experience,” advises Esther Fockenoy, Head of Global Travel Retail for THG, which is now launching two of its highly-rated hair care brands into travel retail: Christophe Robin and Grow Gorgeous.

Both brands are currently listed with travel retail operators in Romania and South Africa and with WHSmith, and will be introduced to Canada’s border duty free stores as part of the Frontier Duty Free Association’s Brand Discovery Program.

“Christophe Robin takes center stage as our premier professional haircare brand, serving both professionals and consumers alike. In contrast, Grow Gorgeous exclusively caters to the direct-to-consumer market,” explains Fockenoy. “Our product range is meticulously crafted to address a spectrum of hair related concerns, including scalp well-being, hair vitality and frizz control. On the other hand, our restorative formulations are a hit with individuals contending with hair damage, often stemming from factors such as heat styling, chemical treatments or environmental stressors.”

Fockenoy points out that while THG’s hero products address universal haircare challenges that resonate with consumers worldwide, it is essential to recognize that preferences for specific products can vary based on cultural, regional, and individual differences.

Tackling the challenge of presenting the optimum hair care assortment in the travel retail environment, Fockenoy observes that elevating the haircare segment in the Travel Retail landscape requires a nuanced process, particularly when deliberating over the optimal arrangement – whether to curate according to brand identity or product categories.

She leans towards allocating dedicated spaces for each brand within the Travel Retail store as it offers a more immersive and impactful customer experience.

“This curated approach promotes rapid brand recognition, helping customers easily identify their preferred labels and leisurely explore the array of offerings. This strategy also offers a canvas for captivating brand narratives, enabling deeper connections with consumers,” she says.

Other presentation options include interactive elements such as a ‘hair health bar,’ and a dedicated section for travel-sized essentials.

THG has some high profile activations underway to bring its brands to the traveling consumer’s attention, including an ambitious project in collaboration with WHSmith that includes digital screen videos on shop windows for Grow Gorgeous. The company is also implementing eye-catching mega and branded shelf strips with more activations in 2024 in partnership with other companies.

“To bring all of these initiatives to fruition, we’re currently placing a strong emphasis on education and staff training. This is vital in ensuring that we have the most knowledgeable and enthusiastic brand ambassadors in the field,” said Fockenoy.

It’s a 10

With its cult-classic product, the Miracle Leave-In, It’s a 10 has grown exponentially becoming a global brand now sold in over 73 countries. More than 10 million bottles of the product are sold annually and It’s a 10 products are sold in more than 25,000 salons and 15,000 professional chains like Ulta in the U.S.

“We would love to have the same success with our products within the travel retail sector. We believe that professional haircare should be accessible to travelers everywhere to experience the magic firsthand that is It’s a 10,” comments It’s a 10 founder & CEO Carolyn Aronson.

It’s a 10 started its venture into Travel Retail in late Spring 2023, and since has been working with several key retailers in all segments from airports, cruise and border doors to start launching this fall with an expanded roll out in 2024, says Aronson.

“Earlier this year we announced our partnership with International Brand Builder’s Inc. and are thrilled to expand the loyal customer we’ve gained over the last 17 years of business and furthering success of launching in over 75 countries this year.”

Founded by a hair stylist/salon owner who has been in the industry 38 years, at its core, It’s a 10 is a professional haircare brand with a focus on high-quality mid-priced prestigious products sold at salons and through leading professional retailers Sally Beauty and Ulta Beauty.

“Our direct-to-consumer channel is also very strong, with all products available on It’s a 10’s website. Our hero products are our Miracle Leave In’s, Miracle Blow Dry H20 Shield, and Miracle Shine Spray,” Aronson explains.

“We travel often and noticed there were no shops in airports carrying quality haircare. To fill this gap, we’re bringing our products to more travelers, leveraging our travel sizes that are well suited for travel retail. Expanding into this market helps us reach more consumers internationally and domestically and after experiencing the product firsthand, will ultimately become loyal consumers to the brand,” she continues.

For travel retail, the company has created a travel retail assortment that focuses on travel size products, sets and travel duos in its bestselling collections. They are also developing creative gondolas and shopping experiences.

“We expect many retailers to display products with creative signage that emulates the It’s a 10 brand and shows the importance that everyone look and feel their best during travels and beyond,” she says.

And the future?

While interest in listing hair care in travel retail is definitely on the rise, even an operator like DFA, which has been selling hair care for several years, is still expanding cautiously.

“We are only looking to add the biggest brands in the category as it is still new and the travelers are not expecting to see these in the duty free shops,” explains Joseph Falic.

“The category in general is growing but we are not promoting it separately. We are slowly expanding within each brand some of the premium product offerings mentioned above (anti-aging shampoo, hair loss prevention, etc.),” he says.

But the opportunity for growth is enticing.

“As an integral part of everyone’s wellness and beauty routine, the haircare industry is expected to grow over $17B in the next five years,” concludes Starboard’s Nedeski.

Lois Pasternak