Building on a transformative 2023, Avolta delivered strong organic growth in Q1 of 8.6% and a further step-up across all financial indicators.

All regions contributed to growth. In addition, Avolta’s Destination 2027 strategy is yielding results, supported by an enhanced customer experience and strong execution, reports the company.

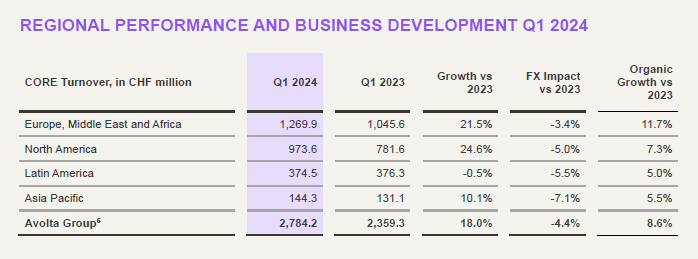

Reported Turnover reached CHF 2,838.4 million (US$3,134.9 million). CORE Turnover of CHF 2,784.2 million (US$3,075.04 million), increased 18% compared to Q1 2023.

Avolta’s CORE organic growth amounted to 8.6% year-on-year (YoY) with all regions contributing to this growth.

EBITDA totaled CHF 168.6 million with an EBITDA margin of 6.1%, +40bps year-on-year (YoY).

Strong overall business momentum continues with April YTD organic growth at around +7.0% year-on-year.

Xavier Rossinyol, CEO of Avolta, stated: “The first quarter of 2024 not only marks a strong beginning of our first full calendar year as Avolta but supports our outlook for 2024 and beyond. We are pleased to report that our strong trajectory continues into Q1 2024, underlining our confidence as we head into the summer season, with KPIs including an organic growth rate of 8.6%, an EBITDA margin of 6.1% and uninterrupted growth trends across the remainder of 2024 and beyond.

“Looking ahead, market conditions remain promising, supporting our commitment to deliver best in class execution and performance. Collectively, the commitment to and execution of our Destination 2027 strategy continues to deliver attractive growth in combination with resilience. Our industry offers prime exposure to travel and long-term consumption trends. Avolta stands out with a uniquely stable and global platform with more than 5,100 Points of Sale across 73 countries.

“The strength of our platform has also been recognized with Moody’s upgrading Avolta’s credit rating from Ba3 to Ba2 and Stable Outlook and S&P’s ratings increase in Q2 from BB to BB+ with a Stable Outlook. Both agencies acknowledged the strength of our business model and sustainable competitive edge in travel retail and F&B, as well as our successful deleveraging efforts of recent months.

“With a strong start in the first quarter and continued positive trends in the second, we confidently prepare for the upcoming summer season. 2024 holds great prospects, underpinned by highly attractive long-term global air passenger traffic trends, expected to double by 2042. The Avolta management team remains confident to deliver on 2024 and beyond. Journey On!”

Recent developments and outlooks

Avolta reports that underlying demand for travel retail, convenience and F&B across the quarter continued to be strong with Group Q1 organic growth up 8.6%. These positive organic growth trends have continued through April, with the company estimating April YTD organic growth at around +7.0% year-on-year (CER) comparable with Easter included in both years.

Over the medium-term, the company confirms its previously announced CORE Turnover growth target of 5%-7% per year on average at constant exchange rates.

This medium-term growth is underpinned by Avolta’s global diversification, which in turn bolsters its resilience. Beyond, Avolta is committed to deliver +20-40bps of CORE EBITDA margin improvement p.a. as it continues to increase its operational efficiency, and +100bps-150bps EFCF conversion, with a c. 4% CAPEX on CORE Turnover p.a.

As part of the Dufry-Autogrill business combination, Avolta reconfirms its target of achieving full run rate synergies of CHF 85 million in 2024, and integration related costs to reach CHF 25 million during the year.

Assuming current exchange rates remain stable for the remaining part of 2024, Avolta expects 2024 currency translation to be at the lower-end of the previously communicated -2% to -3% range.

Regional performance: The Americas

North America

Turnover reached CHF 973.6 million with organic growth of 7.3% YoY. In the US, growth across both travel retail and F&B was robust, underpinned by solid traffic trends and strong demand for the duty-free segment. Canada continued to benefit from the progressive recovery of international traffic.

Over the quarter, Avolta invested in enhancing its duty free and F&B offerings throughout North America. Hudson opened its first duty free store in Halifax Stanfield International Airport and a Hermès boutique at Vancouver International Airport, as well as introducing the locally inspired Bryant Park Market by Hudson to Terminal 5 at John F. Kennedy International Airport and numerous travel convenience and retail stores to Dulles International Airport.

In F&B, HMSHost brought a sense of place to the terminal with the opening of Angie’s Subs at Jacksonville International Airport and Summit House at Calgary International Airport, and introduced a unique Chick-fil-A quick-service restaurant that serves both landside and airside travelers at Charleston International Airport.

Latin America (LATAM)

Turnover came in at CHF 374.5 million with YoY organic growth of 5.0%. Growth in Brazil, Chile, Colombia and Uruguay was solid thanks to international traffic recovery.

This went someway to offset the negative trend in Argentina as a result of the unfavorable macroeconomic scenario. Mexico and Caribbean continued to enjoy leisure-driven demand.

Avolta grew in the region in the first quarter, with the award of a new six-year duty-paid contract at Maceió-Zumbi dos Palmares International Airport (Brazil), as well as establishing an innovative collaboration agreement with Corporación America Airports, a leading private airport operator managing 53 airports in six countries, to elevate the airport retail experience in Uruguay. This collective effort aims to design, implement, and operate duty-free stores that significantly enhance the overall airport experience for travelers through an innovative digitalized and data-driven approach.