The Duty Free World Council (DFWC) reports significant changes in both purchase drivers and barriers, as revealed in the DFWC Q3 global shopping monitor.

The Duty Free World Council (DFWC) reports significant changes in both purchase drivers and barriers, as revealed in the DFWC Q3 global shopping monitor.

The research, which has been commissioned by the DFWC from Swiss-based research agency m1nd-set, was conducted over the three months from July – September 2022 and compares the findings with pre-Covid shopper behavior during the same period in 2019.

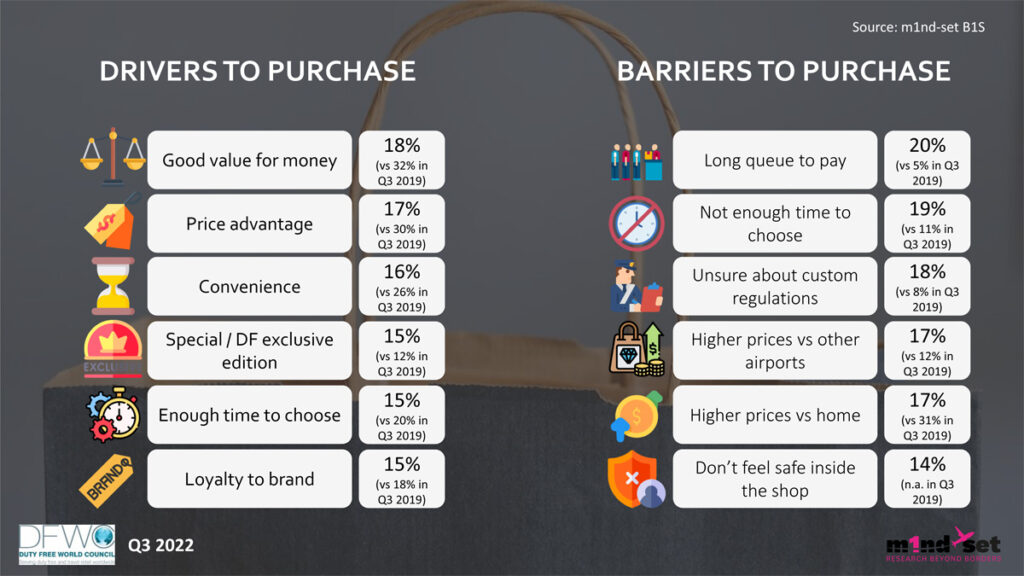

One of the most significant evolutions from the pre- to post-Covid period is the decline in importance of the key shopping drivers, albeit with one exception. At the same time, the main barriers to purchase have, for the most part, increased among shoppers.

Value for money and price advantage, the top two purchase drivers, declined from 32% and 30% of shoppers citing these in Q3 2019 to 18% and 17% respectively in Q3 this year.

Value for money and price advantage, the top two purchase drivers, declined from 32% and 30% of shoppers citing these in Q3 2019 to 18% and 17% respectively in Q3 this year.

Convenience as a reason to purchase was quoted by over a quarter of shoppers in Q3 2019 but by only 16% during the same period this year.

Both dwell time and brand loyalty were quoted by 15% of shoppers in Q3 2022, down from 20% and 18% of shoppers in 2019. The only purchase driver which has seen an increase among shoppers over the 3-year period is special editions / duty free exclusives, which rose from 12% in 2019 to 15% in 2022.

Shopping barriers have consistently increased, with more shoppers citing long queues, insufficient time, uncertainty over custom regulations and higher prices compared to other airports as reasons for not purchasing at an airport. The only exception was “higher prices vs home,” which fell over the three years from 31% in Q3 2019 to 17% in Q3 this year.

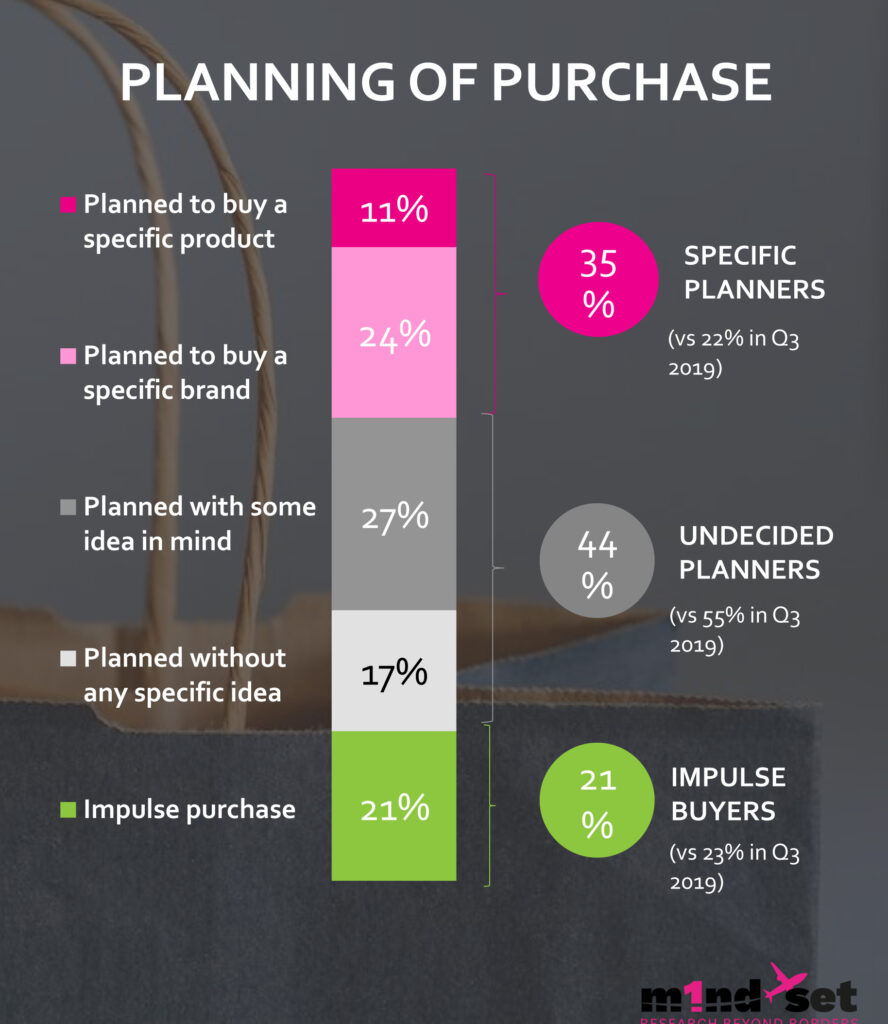

The percentage of global shoppers planning their airport shopping with a clear idea of what they want has increased quite significantly from the pre- to post-Covid period, according to the DFWC shopping monitor – 35% of shoppers planned to purchase either a specific product or brand this year, compared to only 22% in 2019.

The percentage of global shoppers planning their airport shopping with a clear idea of what they want has increased quite significantly from the pre- to post-Covid period, according to the DFWC shopping monitor – 35% of shoppers planned to purchase either a specific product or brand this year, compared to only 22% in 2019.

Undecided planning has decreased over the three years on the other hand, down from 55% in 2019 to 44% in Q3 2022. The percentage of shoppers purchasing on impulse has decreased only slightly from 23% to 21%.

Shoppers have become more self-indulgent since Covid, the research reveals, with 50% of shoppers purchasing products for themselves in Q3 2022, up from 45% in 2019; while gift shopping has declined from 41% to 29% over the 3-year period.

Sarah Branquinho, DFWC President commented on the quarterly monitor: “We are delighted to see the return of the DFWC shopping monitor in partnership with m1nd-set.

“Shopping behavior today is quite significantly different from pre-pandemic times and the research highlights the importance of frontline customer-facing staff.

“The monitor shows how the percentage of shoppers engaging with sales staff has increased from 49% to 71% over the past three years. This demonstrates the importance of staff training, which is why the Duty Free World Council has invested in the DFWC academy.

“The success rate of staff interactions has also increased significantly, up from 51% in 2019 to 78% this year. We cannot emphasize enough the importance of training programs, like those offered by the DFWC Academy to ensure staff have all the necessary tools at their disposal to engage successfully with shoppers and potential shoppers in the travel retail environment.”