The U.S. Travel Association on Jan. 11 released a study that found the United States ranks 17th out of 18 top travel markets in terms of global competitiveness, according to Euromonitor International. The travel association says that decades of underinvestment and a lack of focus and coordination from federal policymakers caused the U.S. to fall behind, while other countries actively apply robust strategies to increase travel and grow economic output.

U.S. Travel commissioned the study to better understand the slow recovery of international inbound travel to the U.S. and how the country can more effectively compete for global travelers in the coming decade.

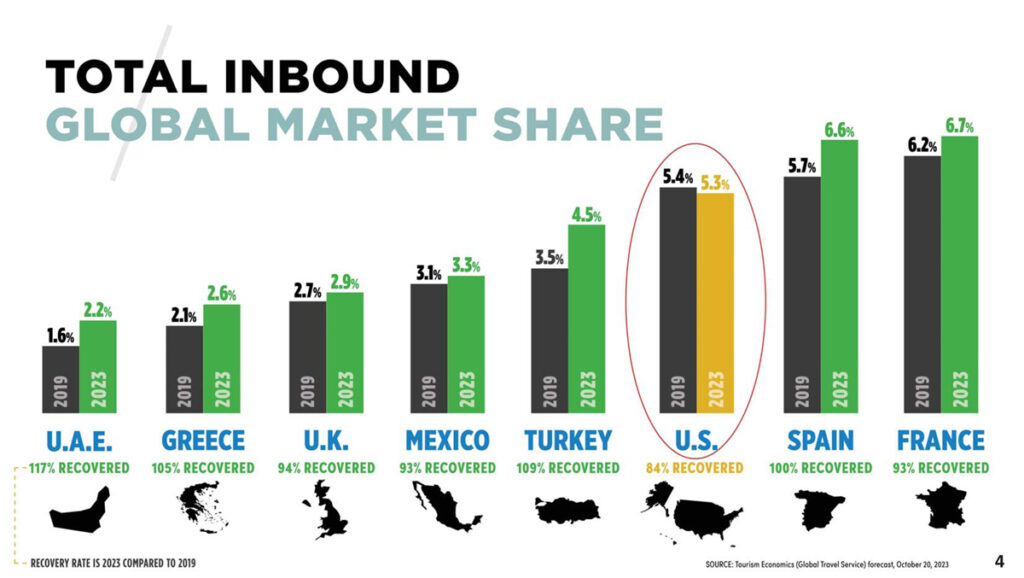

While the U.S. is still the most desired destination for global travelers, it slid to third in total visitation (behind Spain and France). In 2023, it is estimated that the United States welcomed nearly 67 million international visitors—down from 79 million visitors in 2019 and only 84% recovered from pre-pandemic levels, which is far behind other competitors’ recovery rates.

U.S. global market share for long-haul travel declined from 5.4% in 2019 to 5.3% in 2023.

Key Findings

The study assessed 18 top countries for global travel across four weighted categories:

1) National Leadership, 2) Brand & Product, 3) Identity, Security & Facilitation and 4) Travel & Connectivity.

The U.S. notably underperformed in the categories of National Leadership and Identity, Security & Facilitation.

National Leadership

The U.S. ranked last in terms of government leadership on travel-related issues and the strength of its national travel strategy. Most top markets have a minister of tourism; the U.S. has an Assistant Secretary of Commerce for Travel and Tourism position, but the role has not yet been filled or fully funded by Congress. The U.S. has few specific federal policies and little funding to increase inbound visitation.

Other countries (like Canada) have robust national strategies to boost travel spending, improve visitor experiences and highlight lesser-known destinations through key partnerships.

The U.S. scored highly in the travel promotion category thanks in part to the effectiveness of Brand USA and robust emergency funding provided by Congress in 2022.

Brand & Product

The U.S. is a highly desired destination, with diverse products and a strong brand identity among international travelers. The World Economic Forum Safety and Security Pillar—which considers various factors such as the prevalence of violence and crime—was used to rank the safety category, placing the U.S. toward the bottom.

Identity, Security & Facilitation

Excessive visitor visa interview wait times, which approach an average of 400 days in top source markets, placed the U.S. last in this critical category.

The U.S. also ranks unfavorably in terms of the number of countries it permits for visa-free travel, granting the privilege to only 42 nations—far behind the U.K., which allows 102 countries visa-free travel.

The U.S. ranked in the middle of the pack on biometric security screening capabilities, with only 36% of U.S. international airports employing both biometric entry and exit systems. The technology is severely underutilized compared to other nations, despite the fact that a majority of Americans are comfortable with biometric screening if it results in a more efficient air travel experience.

Lengthy Customs wait times upon arrival into the United States, combined with an outdated domestic airport security screening process for many travelers, further resulted in poor rankings for security and facilitation. Meanwhile, other countries evolving their security screening processes—like leveraging technology to remove liquid bans on flights—to be more efficient and globally competitive.

Travel & Connectivity

The U.S. ranks at the top of the global air connectivity network, serving as a major world hub for direct and connecting flights.

Economic Impact

The U.S. Travel Association argues that there is serious economic risk in failing to address inadequacies across the U.S. travel system.

According to an analysis by Tourism Economics:

When a new daily international flight (Boeing 787-10) cannot be accommodated due to Customs and Border Protection staffing shor-tages, the U.S. economy loses up to $227 million per year.

The inefficient aviation security screening process could deter American travelers from as many as three million domestic trips this year, resulting in spending losses of $7.4 billion.

The U.S. risks losing 39 million visitors and $150 billion in spending over the next 10 years due to excessive visitor visa wait times.

However, there are opportunities to facilitate growth, points out the report.

In 2024, the U.S. could gain 2.4 million more visitors if the market were unconstrained by visa wait times. Expanding the Visa Waiver Program (VWP) is also a significant tool to boost competitiveness.

The five countries added to the program from 2008 to 2014 experienced a 52% gain in visit-ation to the U.S. over the first three years. Visits to the U.S. from South Korea increased by 60% by its third year in the VWP and visits from Slovakia surged 70% over the first three years in the program.

Download a summary of the U.S. Travel research here.