The International Air Transport Association (IATA) reports that the recovery in passenger demand, which had been slowing since the Northern hemisphere’s summer travel season, came to a halt in November 2020.

In month-on-month terms, there was a small rise in passenger volumes, but much slower than in the previous months. October and November seasonally adjusted results confirm that the summer recovery stagnated in Q4.

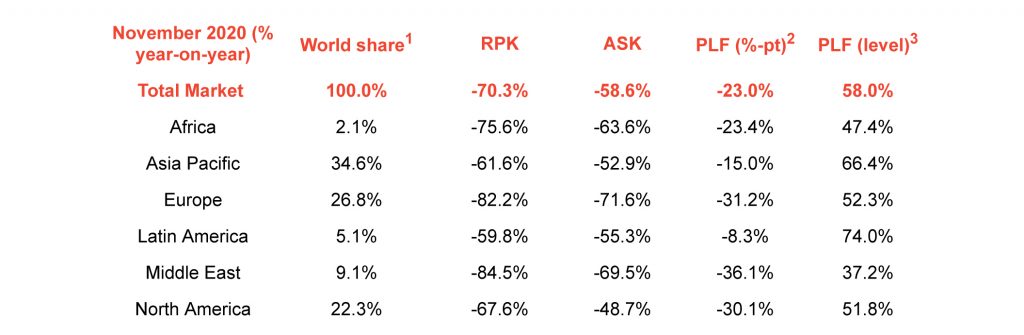

Total demand was down 70.3% compared to November 2019, virtually unchanged from the 70.6% year-to-year decline recorded in October. November capacity was 58.6% below previous year levels and load factor fell 23.0 percentage points to 58.0%, which was a record low for the month.

International passenger demand in November was 88.3% below November 2019, slightly worse than the 87.6% year-to-year decline recorded in October. Capacity fell 77.4% below previous year levels, and load factor dropped 38.7 percentage points to 41.5%. Europe was the main driver of the weakness as new lockdowns weighed on travel demand.

Recovery in domestic demand, which had been the relative bright spot, also stalled, with November domestic traffic down 41.0% compared to the prior year (it stood at 41.1% below the previous year’s level in October). Capacity was 27.1% down on 2019 levels and the load factor dropped 15.7 percentage points to 66.6%.

Alexandre de Juniac, IATA’s Director General and CEO, cites the imposition of more severe travel restrictions and quarantine measures by many governments following new outbreaks of COVID-19 for the collapse in the recovery in air travel. IATA is a strong proponent of vaccines and testing rather that quarantines to protect travelers.

November International air passenger numbers by region

Latin American airlines demand fell 78.6%, compared to the same month last year, improved from an 86.1% decline in October year-to-year. This was the strongest improvement of any region. Routes to/from Central America were the most resilient as governments reduced travel restrictions—especially quarantine requirements. November capacity was 72.0% down and load factor dropped 19.5 percentage points to 62.7%, highest by far among the regions, for a second consecutive month.

North American carriers had an 83.0% traffic drop in November, versus an 87.8% decline in October. Capacity dived 66.1%, and load factor dropped 40.5 percentage points to 40.8%.

Asia-Pacific airlines’ November traffic plunged 95.0% compared to the year-ago period, barely changed from the 95.3% decline in October. The region continued to suffer from the steepest traffic declines for a fifth consecutive month. Capacity dropped 87.4% and load factor sank 48.4 percentage points to 31.6%, the lowest among regions.

European carriers saw an 87.0% decline in traffic in November versus a year ago, worsened from an 83% decline in October. Capacity fell 76.5% and load factor was down by 37.4 percentage points to 46.6%.

Middle Eastern airlines’ demand plummeted 86.0% yoy, which was improved from an 86.9% demand drop in October. Capacity fell 71.0%, and load factor declined 37.9 percentage points to 35.3%.

African airlines’ traffic sank 76.7% in November, little changed from a 77.2% drop in October, but the best performance among the regions. Capacity contracted 63.7%, and load factor fell 25.2 ppts to 45.2%.

Passenger seat capacity climbs back only slowly

Due to faltering air travel demand, airlines have been cautious about adding more capacity back to the market. Industry-wide available seat-kilometres (ASKs) fell by 58.6% yoy in November, just a 1ppts smaller decline than in October. Apart from Europe, all regions reported smaller capacity contractions. Latin American airlines added the capacity back at the fastest pace (+ 8.2ppts, at -55% yoy) to match swiftly recovering demand. The industry-wide passenger load factor remained at record lows across most regions and at the industry level (58%). The only outlier was Latin America with PLF at a relatively strong 74%.